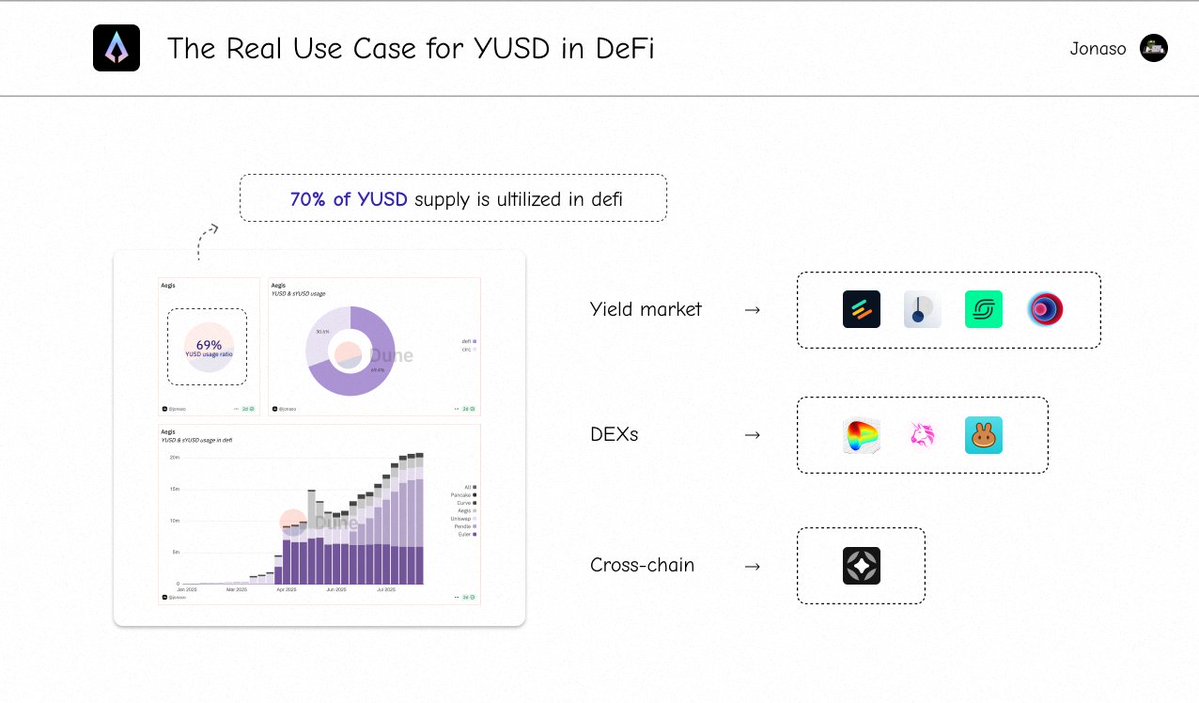

70% of YUSD supply is utilized in DeFi

Currently, holding YUSD passively earns an APR of 11% in @aegis_im

However, this passive return is lower than the yield available through active deployment across leading DeFi protocols

Here's the full breakdown ↓

➢ Yield Markets → YUSD is integrated into several top-tier yield-structuring protocols

- @pendle_fi: PT YUSD offers a 17.5% fixed yield | 1 YT earns 900x points

- @eulerfinance: Up to 105% ROE via the USD1/YUSD vault

- @spectra_finance: PT YUSD offers a 12.5% fixed yield | 1 YT earns 785x points

- @mellowprotocol: Stake sYUSD → rsYUSD to earn native APY from Aegis’ delta-neutral strategy and points from Mellow, Symbiotic, and Aegis

➢ DEX Liquidity → YUSD provides deep liquidity on Curve, Uniswap, and PancakeSwap

This enables users to earn trading fees and farming Aegis Points

➢ Cross-Chain → YUSD is fully bridgeable across Ethereum, BNB Chain, and Avalanche, utilizing the LayerZero OFT standard

If you're looking for a stablecoin that actually works for you, YUSD is built to move, earn, and scale

Show original

10.14K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.