Eight-week trade

Eight-week trade

13Following

56Followers

During the day, he manages 3 quantitative arbitrage private equity funds with a stable annualized return of 25-50% on a scale of 3Y, and is good at arbitrage and data analysis.

Read the following carefully before copying:

(1) Trading strategy:

Basically, it does not make large and small coins, only dozens of medium currencies. Quantitative hedging and hitting factor information to enter the market and conduct quantitative arbitrage trading.

(2) Copy trading settings: It is recommended to be intelligent, please follow the following.

In the 1st and 2nd weeks, the leverage is adjusted to 10x times, cross margin, a single transaction does not exceed 300U, and the total amount of lien is 1wU+.

In the 3rd-6th week, please adjust the leverage to 20x cross margin, and the single copy trade should not exceed 500U. The total amount is 2wU+.

Week 6-8, follow the trader. Set on demand to scale. In order to avoid sharp fluctuations, the total amount is 5wU+.

(3) Precautions: Do not increase funds and leverage at will in the process, investment is risky. Measure your risk tolerance.

TG:@haoxihaoa

Show original

Overview

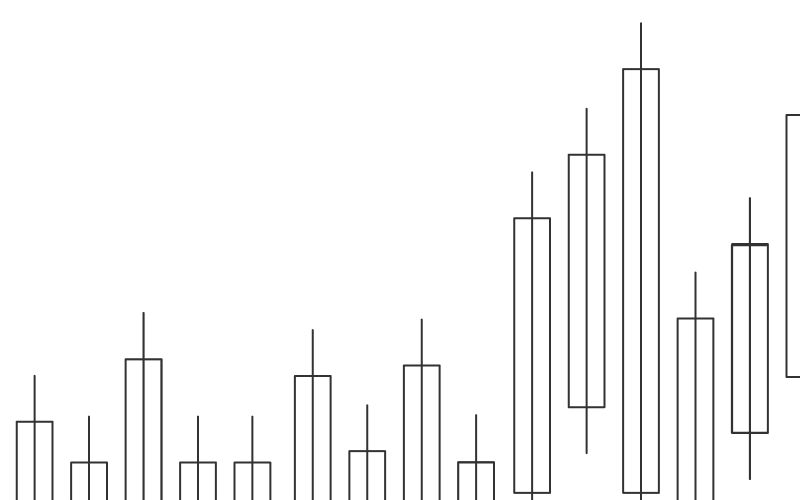

Futures trades

Spot trades

Bot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit9Days w/ loss1

Win rate

90.00%Profit/Loss ratio

6.43:1Average position value

1,540.12Lead trader overview

Days leading trades

10Lead trade assets (USDT)

5,543.04AUM

12,047.66Current copy trader PnL (USDT)

487.08Copy traders18/50

Profit-sharing ratio

8%Copy traders

Cumulative total22

Change in last 7 days

20

M

May123.+1,836.44

+57.18

+37.93

4

c

che***@gmail.com+35.00

5

v

vot***@gmail.com+23.23

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences