To be honest, the recent hype around River on Rootdata and BNB Chain has completely woken me up! Over the past two years, I have witnessed the crazy expansion of DeFi and personally experienced the dilemma of multi-chain capital—the feeling of "assets being locked on an island, liquidity fragmented" is truly one of the most frustrating pain points in the Web3 world.

The Capital Dilemma in the Multi-Chain Era: My Personal Experience

I still remember in the second half of 2023, when I first staked ETH on Arbitrum, thinking I would try something new on BNB Chain. What happened? To participate in the same strategy, I had to cross chains two or three times and exchange assets through a DEX. The fees were outrageous, not to mention the anxiety at every step, fearing that any cross-chain issue would cause my assets to go down the drain. That feeling of "having plenty of assets but only being able to stare helplessly at them on their respective chains" was reminiscent of when I saved up a lot of pocket money as a kid but could only spend it at a small shop.

In the multi-chain era, it looks prosperous, with over 300 Layer2s and more than 30 types of stablecoins, and an endless stream of LSD/LST for BTC and ETH. But capital and liquidity are firmly locked on their respective chains, and the value between ecosystems cannot flow naturally. Every time I want to maximize the use of my assets, it feels like opening bank accounts in different countries—complicated procedures, and not guaranteed to settle successfully.

River's Chain Abstract Stablecoin System: A Disruption of Industry Underlying Logic

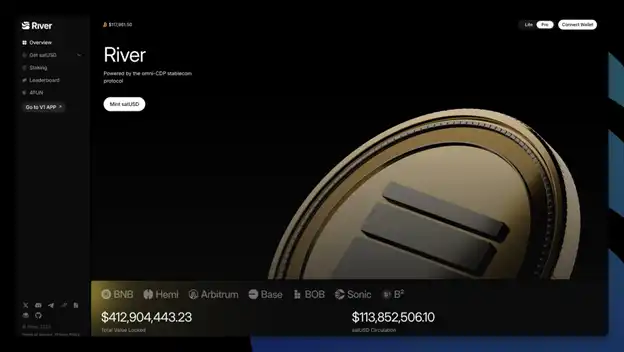

The emergence of River has truly been the most surprising discovery for me this year! It doesn't simply operate stablecoins on a single chain; instead, it uses chain abstraction to completely hide the boundaries between chains. Users can deposit BTC, ETH, BNB, and LST on any chain and then natively mint satUSD on another chain without cross-chain transactions or Wrapped assets, making everything smooth and seamless.

Behind this is actually the combination of LayerZero technology and the OFT standard. I used to think cross-chain was very troublesome, but River has directly smoothed out this pain point. It's like having a globally usable bank account, without needing to open a new account in every country, allowing for instant settlement, payment, and investment, with assets activated at any time for various strategies.

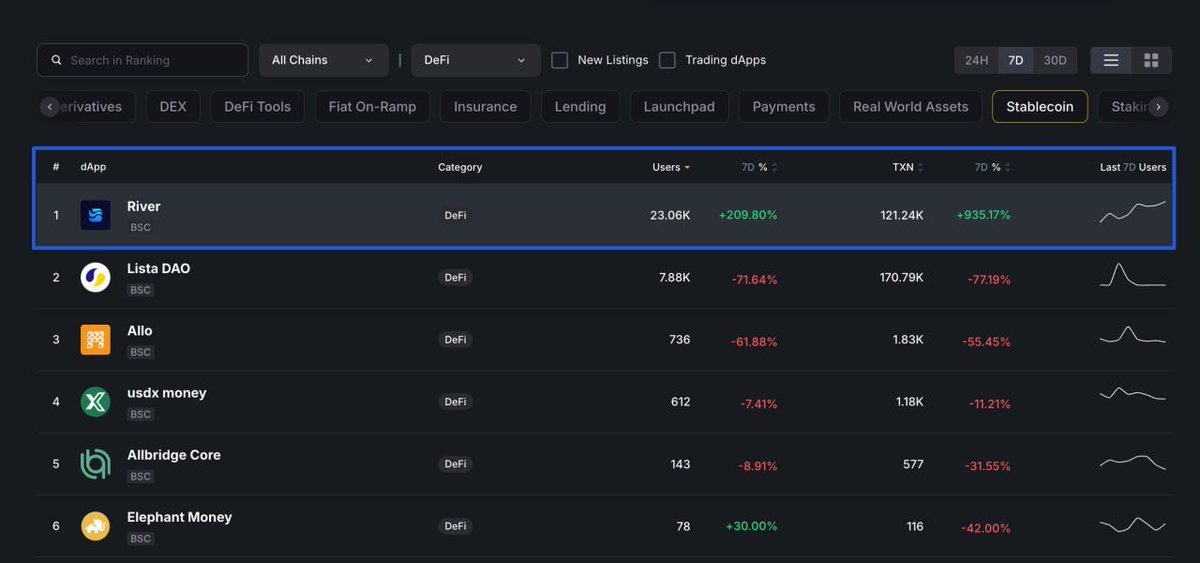

Product Launched: The Real Power of $400 Million TVL

Speaking of data, River's performance over the past two months has been nothing short of phenomenal—accumulating over $400 million in TVL, with satUSD circulation exceeding $100 million. BTC, ETH, BNB, and LST can all be used as collateral, integrating over 30 protocols (Pendle, ListaDAO, Solv, etc.), ranking first in CDP stablecoins across ecosystems like BNB Chain, Arbitrum, Hemi, and BOB.

I have personally tried River's products, and the experience is truly on a different level compared to traditional cross-chain stablecoins. Assets can be instantly activated on any chain, participating in various strategies, and the opportunities for returns multiply instantly, as if a new world has opened up!

Why Do We Need River Now? Personal Insights Amid Industry Changes

As of today, DeFi's TVL has surpassed $150 billion, and the total market cap of stablecoins has reached $270 billion. Logically, the growth in market cap and TVL should lead to a more vibrant ecosystem, but the reality is that liquidity is becoming increasingly fragmented, asset transfers are difficult, and opportunities for returns are concentrated in a few protocols, with high entry barriers for new users.

As an industry veteran, I have seen too many giants and publicly listed companies launch chains and build their own ecosystems, but these "islands" only exacerbate the fragmentation of liquidity. River's chain abstract stablecoin system precisely targets this pain point—it is not about creating another island but about connecting the liquidity and value of multi-chain ecosystems.

Chain Abstract Stablecoin: A Complete Reversal of Industry Logic

River is not just a stablecoin; it is a complete disruption of the traditional logic of asset flow using "fully chain-native" technology. You can fork Ethena's hedging strategy, Liquity's liquidation model, or Usual Money's minting mechanism, but you cannot fork River's underlying architecture of chain abstraction.

All traditional stablecoins have never considered "how to solve the integration issues of cross-chain assets, cross-chain liquidity, and cross-chain returns" from day one of their design. River's satUSD has aimed for a fully chain-native approach since Day 1, adopting the LayerZero structure and being natively deployed in OFT format, and to this day, no similar product has been able to achieve this.

That feeling of "smoothness without needing to cross chains" is something you only realize after trying it once. It's like when I first used cryptocurrency for peer-to-peer payments, I realized how outdated bank wire transfers are!

Personal Summary and Outlook: Connect with Value, Flow with River

What River aims to do is not just issue a stablecoin but to enable any asset in the world to participate in value creation and distribution without barriers, circulating wherever it is needed. Allowing every on-chain asset to flow to any user globally.

As a firsthand witness, I sincerely believe that River's chain abstract stablecoin system is the most noteworthy underlying innovation in the multi-chain DeFi ecosystem. The future of asset flow may be completely transformed because of River!

Connect with value, flow with River. 🎃

Show original

60.41K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.